Disclaimer – The following is not intended as legal, financial, or medical advice; it is sent for Education and Discussion Purposes Only. All items are the opinion of the authors. Thank you all for your support to maintain the operation of this site and welcome to many new subscribers daily. Please assist enable this site to remain active

1 – Trump’s Christianity remarks…

What other national leader would give such a message to a Christian based society ?

2a – JMC: The Great Awakening

The illusion of freedom was all a show. The script has been flipped on these evil demons. Enjoy the show. 💥What a time to be alive!

I’m not exactly sure what is going on in Venezuela, but based on how badly the Dems are throwing a fit about it, I have a hunch. It reminds me of Iran/Ukraine. Destroying Iran’s nuclear facilities was not about Iran. It was about Obama and the Deep State. Obama’s Iran Deal is what paved the way for Iran to create nuclear weapons. Obama essentially offshored nuclear weapon development, and put it in the hands of the ruling Deep State families, via Iran as proxy. This is the same way that Obama/Fauci offshored biological weapon development to Ukraine circa 2014. Obama took US secrets, offshored them, and handed these capabilities over to his Deep State handlers, outside the scope of US oversight, and outside the hands of the US Military. Obama essentially created rogue proxies around the world, with the most dangerous weaponry ever created, and Trump is on a mission to destroy it all. I’m not exactly sure what is going on in Venezuela that has Trump’s attention, but I think it has to do with more than just drug cartels. Venezuela, and South America in general, has been a historical CIA hotspot. My guess is, that Venezuela has some sort of Obama/Deep State assets, similar to Iran and Ukraine. Hence why Trump is after it, and hence why the Dems are freaking out about “unlawful orders”, Hegseth, “war crimes”, drug boats, etc. Is it about cartels, drugs, election fraud, oil, precious metals, something else? I’m not sure, but the enemy always tells us what they value most, based upon what they squeal about the loudest.

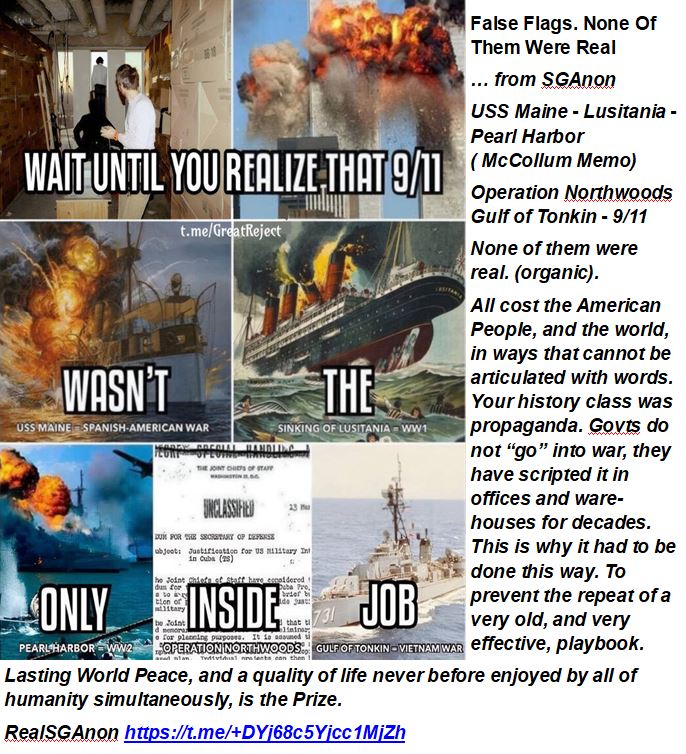

2b – False Flags. None of them were real

2c – The beginning of the end of Big Food

2d – Supreme Court greenlights Purge, thousands of Feds are quitting overnight

3a – Topher – His bills went up after solar?

3b – Big Daddy 7 Dec – Q+A EBS etc

4a – When a Currency Revalues – where it starts and who knows first.

Posted by Mayhem Mel News. Forwarded from Newshound News. This is YOUR Life changing event. Don’t be fooled by others spins.

WHEN A CURRENCY REVALUES — There is no public announcement before a currency revalue. Financial-stability rules prevent governments or central banks from signaling early. A real revalue begins inside central-bank systems when internal FX tables update. Next, major correspondent banks (JPMorgan, Citi, HSBC, BRICS hubs) receive the rate. Then commercial banks get it through internal FX engines — still not public. Only after system sync do public sources update: Bloomberg, Refinitiv, SWIFT, FX APIs. By then, the public is last to know. If it’s not on Bloomberg, Refinitiv, or official central-bank pages, it isn’t real.

4b – RV = The Return of Gold Standard

What exactly is the gold standard? It’s a policy that links the value of a country’s currency to gold. The U.S. adopted it in 1879, and it allowed consumers, banks and businesses to exchange a dollar for actual gold. That may sound like a solid deal, given that actual gold would back up your bucks. But there’s a downside: A country can only issue as much money as it has backed by gold. The upshot is that countries on the gold standard have less flexibility to respond to financial crises or economic downturns. Currently, the U.S. dollar isn’t tied to any specific asset. When did the U.S. abandon the gold standard? The long goodbye to the gold standard began with the Great Depression, when panicked consumers sought to trade dollars for gold.

To keep the country’s gold reserves from becoming depleted, the U.S. had to offer high interest rates as an alternative, which, in turn, made it more expensive to lend money and hampered the country’s ability to rebound from the Depression. In response, President Franklin Roosevelt suspended the gold standard in 1933, a move which is widely credited with helping the country climb out of the Depression. That’s because the decision allowed the government to lower interest rates and pump money into the economy. But the U.S. still allowed foreign governments to trade dollars for gold, until President Nixon abolished the policy in 1971 as a way to keep gold reserves from depletion. Trumps Fed Pick Wants To Revive The Gold Standard. Here’s What That Means.

Link – https://www.cbsnews.com/news/trumps-fed-pick-judy-shelton-gold-standard-explained/

4c – The payroll must be completed before Christmas! Why?

Because AFTER December 25th, the expenditure window closes under the Federal Financial Management Law! What does that Mean? It means if salaries are not processed before Dec 25, they CANNOT be paid from the 2025 budget. They would have to roll into 2026 allocations, which the government DOES NOT want. THIS MEANS THE PRESSURE IS ON

Link – https://x.com/CoachTimothyYT/status/1997637602896207999?s=20

5a – The Origin Of Q

Q was created long ago in 1860 April 1 when 20 Generals placed Abraham Lincoln into office to Fight the Khazarian mafia who created the slave trade and owned 99% of the U.S. Slaves. Today this battle is coming to an end. Trump. Q

5b – The 1980 Silver pattern is repeating – 1,000 oz bought houses then, will again.

5c – Trump Rolls Back Emissions Regulations – What Does this mean for you?

• Biden’s fuel economy mandates: TERMINATED

• Biden’s tailpipe emissions regulations: TERMINATED

• Biden’s emissions waiver for Newsom’s California: TERMINATED

Full Video ↓↓

6 – Local Council Bans Indigenous Flags (Cue Woke Outrage)

7a – Magnet 🧲 free energy machine?

7b – The superfood they turned into a weed: why

7c – 450 Lbs of Food Per Year, Zero Effort

8 – Robin Herd sings Jerusalem